The business’s in depth item variety, coupled with its dedication to client care and protection actions, can make Provident Metals the very best choice for potential buyers trying to find a trustworthy and easy platform for his or her valuable metallic investments.

Provident Metals features a comprehensive variety of cherished metals to cater into the various desires of investors. Regardless if you are on the lookout to purchase gold and silver bullion, copper bullion, or many different gold and silver coins, Provident Metals has you covered.

So, what types of precious metals are you able to include things like inside your shiny new Gold IRA? The celebrities of the clearly show are:

Contributions designed to your Gold IRA can be tax-deductible, presenting prospective savings on recent taxable earnings. It is significant to adhere to the IRS rules pertaining to contribution restrictions, as exceeding these restrictions can lead to penalties and considerable tax implications.

Your gold IRA can incorporate additional than simply gold. The truth is, a far better term for that expenditure will be “important metals IRA.” The commonest property used to fund a treasured metals IRA are gold and silver.

To further more illustrate the constructive shopper sentiment, take a look at the following customer opinions:

For those who have any issues or thoughts, the American Hartford Gold customer service crew is available to assist you.

“Buying a gold IRA offers a time-examined strategy for asset preservation, but it surely’s significant not to miss the potential benefits of other precious metals.

Provident Metals’ determination to delivering a broad item array and expenditure services can make it a a single-end buy your cherished metal desires.

After you have picked your gold IRA website custodian, you'll be able to open up your gold IRA. Whenever your gold IRA account is open up, you are able to then start out the rollover method.

Diversifying in just a precious metals IRA can offer security and safety, shielding retirement investments in the volatility of standard economical marketplaces.

The two domestic and Intercontinental depositories offer significant-security features and provide insurance policies protection to safeguard versus theft and loss.

Buying a Gold IRA supplies diversification, security, and likely development for retirement price savings, in conjunction with tax advantages including tax-deductible contributions for common Gold IRAs and tax-cost-free growth for Roth Gold IRAs. It’s a wise solution to protected your monetary long run.

Wanting to include some glitter to the retirement portfolio? It’s time to select and purchase your gold investments. But before you do, ensure you decide on approved dealers and keep away from prohibited investments.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Brandy Then & Now!

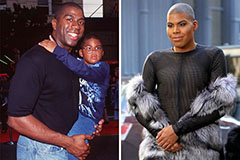

Brandy Then & Now! Earvin Johnson III Then & Now!

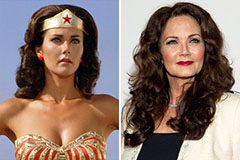

Earvin Johnson III Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!